Pradhan Mantri Jeevan Jyoti Bima Yojana | PMJJBY 2023 Apply Online | Check PM Jeevan Jyoti Bima Yojana Application Status | PMJJBY Claim Process

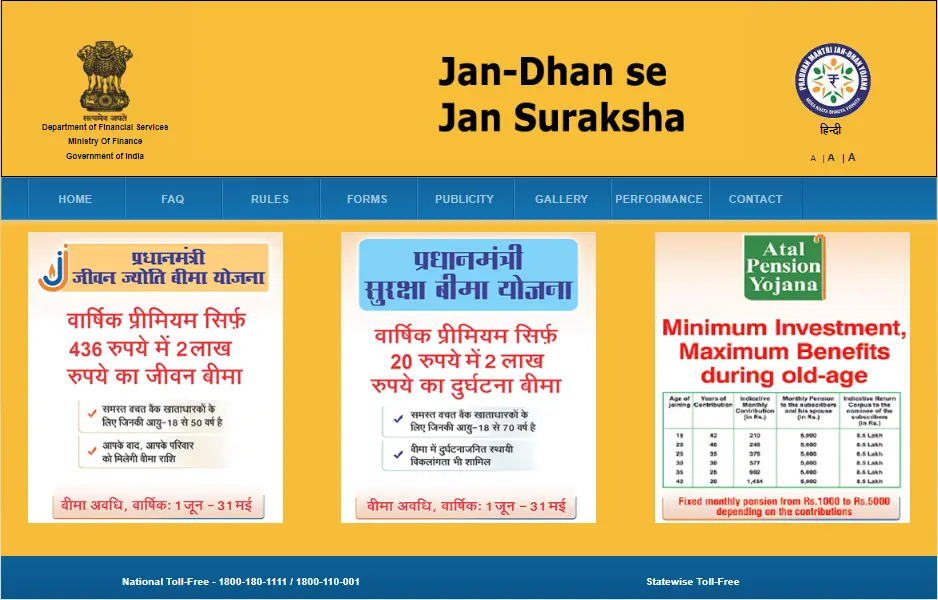

The Government of India runs many schemes to benefit citizens, and Pradhan Mantri Jeevan Jyoti Bima Yojana is one of them. The Life Insurance Corporation of India and other private and public sector banks initiated this scheme. The Pradhan Mantri Jeevan Jyoti Bima Yojana was launched in April.

If an applicant dies before the age of 55 for any reason, the government will provide a life insurance policy of ₹2,00,000 to his nominee. In this article, we will tell you all the information about the scheme including its benefits, eligibility, application process, and required documents.

Join our telegram group for getting the latest update regarding All Government Schemes and Yojana

Pradhan Mantri Jeevan Jyoti Bima Yojana 2023

PM Jeevan Jyoti Bima Yojana is a fantastic initiative by the Government of India that will not only provide insurance to the poor and underprivileged, but their children will also benefit greatly in the future. Citizens must be at least 18 years old and no older than 50 years old to participate in policy development. If you want to take benefit from the Pradhan Mantri Jeevan Jyoti Bima Yojana, apply under this scheme.

Overview of the PMJJBY Scheme

| Scheme Name | Pradhan Mantri Jeevan Jyoti Bima Yojana |

| Initiated By | The Central Government |

| Beneficiary | Citizens of the country |

| Purpose | Providing Policy Insurance |

| Official Website | https://www.jansuraksha.gov.in/ |

Objectives of the Pradhan Mantri Jeevan Jyoti Bima Yojana

This is an excellent scheme for citizens who wish to provide social security to their families even after their death. Under the PM Jeevan Jyoti Bima Scheme, if a policyholder dies between the ages of 18 and 50, the government will pay a sum of Rs. 2 lakhs to the policyholder’s family so that he can live a happy life. PMJJBY coverage for Indian citizens is required under this scheme. This scheme will provide insurance to people who are not necessarily poor or disadvantaged.

Benefits of the PMJJBY Scheme

- This scheme is available to citizens aged 18 to 50.

- After the policyholder’s death under this scheme, the policyholder’s family can renew the PMJJBY from year to year. This scheme’s members must pay an annual premium of Rs.330. A sum of Rs 2 lakh in life insurance will be provided.

- The annual premium for this plan is due on or before May 31st of each year.

- If the annual premium is not deposited by this date, the policy can be renewed by paying the entire annual premium in one lump sum and submitting a self-declaration of good health.

How to Apply for the Pradhan Mantri Jeevan Jyoti Bima Yojana?

Interested citizens of the country who want to apply for the Jeevan Jyoti Bima Yojana should follow the procedure outlined below.

- Go to Jan Suraksha’s official website.

- Download the PDF of the PMJJBY Application form, and fill out the form with all of the requested information.

- After filling out all of the information, you must deposit it in a bank where you have an active savings account.

- You must ensure that you have enough money in your account to pay the premium.

- After that, you must submit a consent letter including the consent form to join the scheme and authorise the auto-debit of the consent letter and premium amount.

You can download the Pradhan Mantri Jeevan Jyoti Bima Yojana application form or consent-cum-declaration form in the desired language from the official website.

How to Claim the Amount from the PM Jeevan Jyoti Bima Yojana?

- After the death of the insured person, his nominee can make a claim under the Jeevan Jyoti Bima Yojana.

- Following that, the policyholder’s nominee should contact the bank first.

- The nominee must then go to the bank and obtain the Pradhan Mantri Jeevan Jyoti Bima Claim Form and Discharge Receipt.

The nominee must then submit the claim form, discharge receipt form, photographs of the death certificate, and the cancelled cheque.

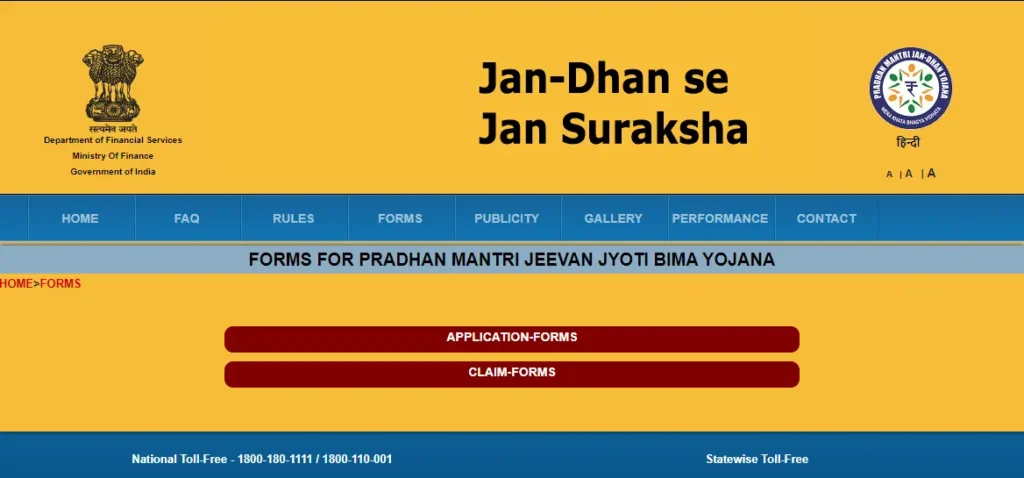

How to Download PMJJBY Application Form or Claim Form?

- Visit the official website, and click on the “Forms” option.

- A new page will open, click on the “Pradhan Mantri Jeevan Jyoti Bima Yojana” option.

- You will get two options, “Application Form” and “Claim Form”

- Select as per your need and download the form.

Pradhan Mantri Jeevan Jyoti Bima Yojana Premium Amount

The policyholder must pay a yearly premium of Rs 330 under this plan. The amount will be deducted automatically from the subscriber’s savings account in May of each year. Under this scheme, an affordable premium rate is available to all citizens from almost all income groups, including EWS and BPL. The insurance coverage under Pradhan Mantri Jeevan Jyoti Bima Yojana will begin on June 1st of the same year and will last until May 31st of the following year. In PMJJBY, no medical examination is required to purchase insurance.

| Insurance premium to LIC/Insurance Company | Rs.289/- |

| Reimbursement of expenses for BC/Micro/Corporate/Agent | Rs.30/- |

| Reimbursement of Administrative Charges of Participating Bank | Rs.11/- |

| Total Premium | Rs.330/- |

Revised Premium Amount

The Central Government revised the premium rates of the PM Jeevan Jyoti Bima Yojana on May 31, 2022. The decision to raise the premium rates for this plan was made in light of the long history of negative claims. Beneficiaries will now be required to pay a daily premium of 1.25 under this scheme. The monthly premium will now rise from 330 to 436. There has been no change in the premium rate under this scheme in the last seven years. This scheme has 6.4 crore active customers as of March 31, 2022.

Why was Rs. 436/- Debited from the Policyholder

Many citizens’ bank accounts have been debited by Rs 436/- in May who had registered for the PMJJBY. Every year on June 1st, the scheme will renew. If the beneficiary has more than one account and the premium amount has been deducted from more than one account, you can request a refund from your bank. This scheme’s benefits are valid for one year.

Pradhan Mantri Jeevan Jyoti Bima Yojana Claims by Citizens

The PM Jeevan Jyoti Bima Yojana can only be used with a bank account. In the year 2020-21, death claims worth Rs 1134 crore were paid to 56716 citizens under the scheme. Financial assistance of ₹ 2,00,000 has been provided to all these citizens. Due to the raise of COVID, the claim payment has also increased. And, half of the claims were for deaths caused by COVID. This scheme will have registered 102.7 million people by the year 2021.

Death Occurs Due to COVID, Take the Advantage of PMJJBY

All citizens whose family members died as a result of COVID or any other cause and who were registered under this scheme are eligible for an insurance payout of up to ₹ 2,00,000. He will be eligible for this scheme only if the policyholder purchases it in 2020-21. This policy can be purchased at any age between 18 and 55.

Risk Cover After 45 Days

If you are already enrolled in this scheme, you don’t need to re-apply each year. The premium will be deducted from your bank account every year, and your renewal will be completed. This scheme is only available to new buyers for the first 45 days after enrolment. Only after 45 days have passed can a claim be filed. The company will not settle any claims in the first 45 days. However, if the applicant’s death was the result of an accident, the applicant will be compensated.

Re-join the Pradhan Mantri Jeevan Jyoti Bima Yojana

Anyone can re-enrol in the Pradhan Mantri Jeevan Jyoti Bima Yojana by paying a premium and submitting a health-related self-declaration.

Pradhan Mantri Jeevan Jyoti Bima Yojana Statistics

| Financial year | Number of registered citizens | Total number of claims received | Total number of claims delivered | Distributed amount |

| 2016-17 | 3.10 | 62,166 | 59,118 | Rs 1,182.36 crore |

| 2017-18 | 5.33 | 98,163 | 89,708 | Rs 1,794.16 crore |

| 2018-19 | 5.92 | 1,45,763 | 1,35,212 | Rs 2,704.24 crore |

| 2019-20 | 6.96 | 1,90,175 | 1,78,189 | Rs 3,563.78 crore |

| 2020-21 | 10.27 | 2,50,351 | 2,34,905 | Rs 4,698.10 crore |

Eligibility Criteria for Applying the PMJJBY 2023

- Citizens applying for this policy must be between the ages of 18 and 50.

- The premium for this tram plan is Rs.330 per year.

- The policyholder must have a bank account under this scheme. Because the government will transfer the funds directly to the beneficiary’s bank account.

- Every year, the subscriber must keep the required balance in their bank account at the time of auto-debit on or before May 31st.

Required Documents

- Aadhaar Card of the applicant

- Identity Card

- Bank Account Passbook

- Mobile Number

- Passport Size Photo

Limitations of the PMJJBY 2023

- In the event that the bank’s account is closed.

- If the premium amount is not available in the bank account.

- On reaching the age of 55.

- Pradhan Mantri Jeevan Jyoti Bima Yojana can be taken from a single insurance company or bank.

How to Get Performance Related Information?

- Visit the official website.

- Then, select the “performance” option from the homepage.

- A new page will open, where you will get all the information on your computer screen.

Obtain Information Related to Publicity

- Visit the official website.

- Then, select the “publicity” option from the homepage.

- A new page will open, select the “publicity material”

- The relevant information will appear on your computer screen.

Check the Rules

- Visit the official website.

- Then, select the “rules” option from the homepage.

- A list of all the rules will now appear on your screen.

- Select an option you need, and the details will appear on your computer screen.

Helpline Number

Go to the official website, and click on the “Contact” option on the homepage. A new page will open containing the list of state-wise toll-free numbers.

| Contact Details | 18001801111 / 1800110001 |

Frequently Asked Questions

Under the PMJJBY, you will receive a benefit of 2 lakhs on an investment of only Rs 436. The minimum age to purchase this policy is 18 years, and the maximum age is 55 years.

You can only use one bank account to access the Pradhan Mantri Jeevan Jyoti Bima Yojana. This policy cannot be linked to another account as a result of this. This insurance benefit is only available after 45 days of purchasing the policy. However, the 45-day condition does not apply in the event of death in an accident.

The Pradhan Mantri Jeevan Jyoti Bima Yojana provides coverage for the insured’s death, regardless of the cause. In the event of the life assured’s death, the amount will be paid to the nominee. The Pradhan Mantri Suraksha Bima Yojana insures against accidental death or disability.

Important Links

| Join Telegram Group | CLICK HERE |

| Visit Official Website | CLICK HERE |

| Online Form Download | CLICK HERE |

Related Article:

- Pradhan Mantri Suraksha Bima Yojana: PMSBY 2023

- Prime Minister Agriculture Irrigation Scheme: PMKSY 2022

- Pradhan Mantri Shram Yogi Mandhan Yojana: PMSYM Yojana 2022

- Pradhan Mantri Karam Yogi Maandhan Yojana 2022

- Pradhan Mantri Mudra Loan Yojana 2022 (PMMY): Apply for Online Loan

Join our telegram group for getting the latest update regarding All Government Schemes and Yojana

![PM Sahaj Bijli Har Ghar Yojana: Saubhagya 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/04/PM-Sahaj-Bijli-Har-Ghar-Yojana.webp)

![Nijashree Housing Scheme 2024 For LIG/MIG [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijashree-Housing-Scheme.webp)

![Hawker Support Scheme 2024: Eligibility and Benefits [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Hawker-Support-Scheme.webp)

![Nijo Griha Nijo Bhumi Scheme 2024 For Homeless People [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijo-Griha-Nijo-Bhumi.webp)

![West Bengal Gatidhara Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Gatidhara-Scheme-West-Bengal.webp)

![West Bengal Matsyajeebi Bandhu Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Bandhu-Scheme-in-West-Bengal.webp)

![Matsyajeebi Credit Card Scheme In West Bengal [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Credit-Card-Scheme-in-West-Bengal.webp)