Pradhan Mantri Awas Yojana Urban | PMAY Urban Updated Guidelines | Eligibility Criteria, Application Process, and PMAY-U Updated Guidelines

Pradhan Mantri Awas Yojana-Urban or PMAY (U) was established for Housing for all urban missions. The PMAY scheme was launched in the year 2015. In January 2021 Ministry of Housing & Urban Affairs updated the scheme guidelines. In the housing project, 35% of the houses are constructed for the EWS category, LIG (Low Income Group), and MIG 1 & 2 (Middle Income Group 1 & 2).

Pradhan Mantri Awas Yojana-Urban (PMAY-U) Benefits & Features

- For House Loans interest subsidy of up to 6.5%.

- There is no limit on the home loan amount or cost of the property.

- PMAY schemes can encourage women to be homeowners or co-applicants.

- Interest subsidy for PMAY home loans applies to a maximum loan tenure of 20 years or the loan tenure availed by the borrower, whichever is lower.

- For senior citizens and differently-abled ground floor accommodation is compulsory

- For house construction, it’s mandatory to use sustainable and eco-friendly materials.

- The Government of India grants Rs. 1 lakh per house for slum rehabilitation.

- The quality of the house/flat will be as per the guidelines of the National Building Code (NBC) and National Disaster Management Authority (NDMA).

- Approval of building designs is compulsory before construction.

PMAY Beneficiary

- A beneficiary family includes a husband, wife, unmarried sons/daughters

- Women falling under EWS and LIG income groups

- An adult earning member of the family with a pucca house of built-up area less than 21 sq. m, and that may be included for enhancement of existing dwelling units up to 30 sq.m.

- SC or Scheduled Caste, ST or Scheduled Tribe, and OBC or Other Backward Class

Eligibility Criteria of EWS Category

- Households that belong to the EWS category are defined as households having an annual income up to Rs. 3, 00,000 (Rupees Three Lakh).

- Although a beneficiary family will comprise a husband, wife, and unmarried son/ daughters.

- As per local conditions in consultation with the Ministry, States/UTs shall have the flexibility to redefine the annual income criteria.

- The family of beneficiaries should not own a pucca house either in his/her name or in the name of any member of their family in any part of India.

Low Income Group (LIG) Eligibility Criteria

- LIG households are defined as households having an annual income from Rs.3, 00,001 (Rupees Three Lakh One) up to Rs.6, 00,000 (Rupees Six Lakhs).

- As per local conditions in consultation with MoHUA, States/UTs shall have the flexibility to redefine the annual income criteria.

Eligibility Criteria of Middle Income Group (MIG)

- MIG-I households have an annual income ranging from Rs.6,00,001 (Rupees Six Lakh One) to Rs.12,00,000 (Rupees Twelve Lakh).

- MIG-II households earn between Rs.12,00,001 (Rupees Twelve Lakh One) and Rs.18,00,000 (Rupees Eighteen Lakh) per year.

BLC Component Eligibility Criteria

If the beneficiary has 21 sq. mt. the area contained a pucca house or a semi-pucca house, and they don’t have i.e. room, kitchen, toilet, bath, or a combination of these, it may be taken up for subject to ULB/State ensuring the safety of the house to following conditions:

- The total carpet area after enhancement must be between 21 sq. mt to 30 sq.mt.

- Enhancement shall mean adding a minimum carpet area of 9.0 sq. mt into the existing house with pucca construction of at least one room with kitchen or one habitable room and bathroom and toilet conforming to NBC norms.

- In the proposed Annexure 7D of the PMAY(U) guidelines, the details of the enhancement proposals under the BLC vertical shall be submitted

PMAY (U) Scheme for different categories:

| Criteria | (CLSS – EWS +LIG) | CLSS (MIG-I) | CLSS (MIG-II) |

| Applicability | Loans approved on/after 17/06/2015 | Loans approved on/after 01/01/2017 | Loans approved on/after 01/01/2017 |

| Validity | 31/03/2022 | 31/3/2021 | 31/3/2021 |

| Property should be Family’s | 1st home | 1st home | 1st home |

| Max term of the loan (on which subsidy will be calculated) | 20 years | 20 years | 20 years |

| NPV Discount Rate | 9.00% | 9.00% | 9.00% |

| Subsidy Amount | Rs.2,67,280 | Rs.2,35,068 | Rs.2,30,156 |

| Subsidy % | 6.50% | 4.00% | 3.00% |

| Max Loan Amount for Subsidy | Up to Rs.6 lakh | Up to Rs.9 lakh | Up to Rs.12 lakh |

| Woman Ownership | Required for new acquisition (No need for the existing property) | No | No |

| Location | All statutory towns as per Census 2011 and towns notified subsequently | All statutory towns as per Census 2011 and towns notified subsequently | All statutory towns as per Census 2011 and towns notified subsequently |

| Property Area (Carpet Area) | 30/60 sq.m. | 150 sq.m. | 200 sq.m. |

| Household/ Annual Income (Rs.) | Up to Rs.6 lakh | Rs.6.01 lakh to Rs.12 lakh | Rs.12.01 lakh to Rs.18 lakh |

CLSS Awas Portal (CLAP)

CLSS Awas Portal (CLAP) is a web-based platform, developed and implemented by the Mission. This software works on a real-time basis with UIDAI for Aadhaar validation. CLAP also communicates with the PMAY (U) MIS System to provide advance information on a potential beneficiary being processed by PMAY (U). For several stakeholders to track the development of the CLSS vertical, dashboards and reports has added to the CLAP platform.

Central Nodal Agencies (CNAs)

Nodal Agencies identified by the Ministry for implementation of the Credit Linked Subsidy component of the Mission.

Implementing Agencies (IAs)

Urban Local Bodies, Development Authorities, Housing Boards, etc are agencies as Implementing Agencies. The SLSMC or State Government/ State Level Sanctioning and the Monitoring Committee will select them for implementing Pradhan Mantri Awas Yojana (Urban) – Housing for All Mission.

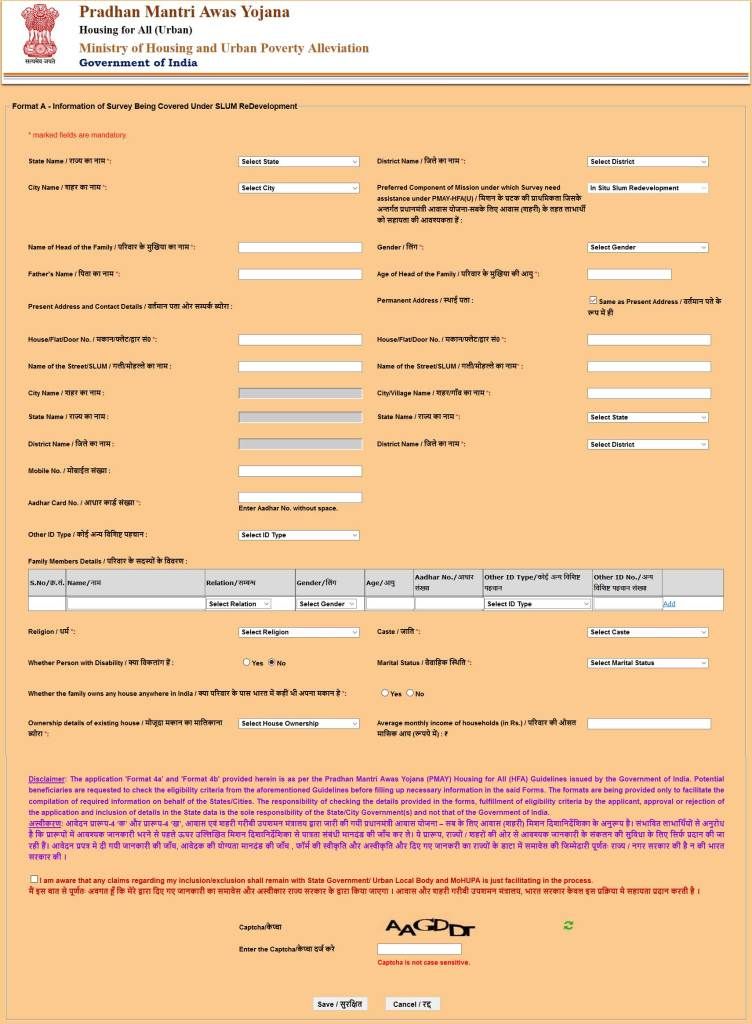

How to apply for PM Awas Yojana Urban Schemes

- Visit- https://pmaymis.gov.in, for an online application.

- Click on the “Citizen Assessment” menu, then Select “Benefit under other 3 components”.

- Enter your 12-digit Aadhaar number as mentioned on your Aadhaar Card.

- After verification, the PMAY application page will appear.

- Enter your mandatory details.

- Tick on the checkbox.

- Enter the correct captcha and click the “save” option.

- Save the system-generated application number for future reference.

- Download and print your PMAY application form.

- Submit your form to the nearest Common Service Center (CSC) with all the supporting documents.

How to Download the PMAY Application Form

To download your PMAY application form online, you have to follow these steps:

- Visit the official PMAY website at https://pmaymis.gov.in.

- Go to the homepage, and select the “Print Assessment” option from the “Citizen Assessment” menu.

- Access the application form either by providing your:

- Assessment ID.

- Name, Father’s Name & Mobile No.

- Enter details as per your selection and print the assessment form.

How to Check Your PMAY Status

To check the current status of your PMAY application, you have to visit online at the official website of Pradhan Mantri Awas Yojana – https://pmaymis.gov.in. Track the PMAY application status online either through your:

- Name, Father’s Name, or Mobile Number.

- Assessment ID.

List of NBFCs/Banks Linked to Pradhan Mantri Awas Yojana Scheme

| Yes Bank | ICICI Bank Ltd. | Axis Bank Ltd. | SBI |

| Bank of Baroda | LIC Housing Finance | Kotak Mahindra Bank | Bajaj Housing Finance Limited |

| Federal Bank | IIFL | Karnataka Bank Ltd. | Fullerton |

Pradhan Mantri Awas Yojana (PMAY) Toll-Free Helpline Numbers

| Central Nodal Agency (CNA) | E-mail ID | Toll-Free Numbers |

| NHB | clssim@nhb.org.in | 1800-11-3377, 1800-11-3388 |

| HUDCO | hudconiwas@hudco.org | 1800-11-6163 |

List of PMAY Guidelines:

| Guidelines | Download Links |

| ARHC Operational Guideline | Download from here |

| Amendments in guidelines of Pradhan Mantri Awas Yojana (Urban) Mission- regarding. | Download from here |

| Revised Operational Guidelines for construction of Demonstration Housing Projects (DHPs) in the States/UTs. | Download from here |

| Amendments In Pradhan Mantri Awas Yojana (urban) – Housing For All Mission Guidelines Jan 2018 (Hindi Version) | Download from here |

| Amendments In Pradhan Mantri Awas Yojana (urban) – Housing For All Mission Guidelines Jan 2018 | Download from here |

| Amendments In Pradhan Mantri Awas Yojana (urban) – Housing For All Mission Guidelines June 2017 | Download from here |

| PMAY(U) Passbook for BLC beneficiaries (Hindi) | Download from here |

| PMAY(U) Passbook for BLC beneficiaries (English) | Download from here |

| Amendments in the Guidelines of Pradhan Mantri Awas Yojana (PMAY)-HFA (U) Mission 21st June 2016 | Download from here |

| Revised Pradhan Mantri Awas Yojana Guidelines (Hindi) | Download from here |

| Revised Pradhan Mantri Awas Yojana Guidelines (English) | Download from here |

Frequently Asked Questions

No, you can’t. An Aadhaar number is mandatory for applying to the PMAY scheme. If you don’t have an Aadhaar card, as an individual you can always apply for it from the nearest CSC.

No, the PMAY CLSS is only applicable to properties in urban areas.

If you own a property without a dwelling, you are eligible for the CLSS interest subsidy on a home loan for development on that plot.

Yes, you need to pay a nominal fee of Rs. 25 + GST at the time of form submission. Potential beneficiaries can apply online without paying fees.

![PM Sahaj Bijli Har Ghar Yojana: Saubhagya 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/04/PM-Sahaj-Bijli-Har-Ghar-Yojana.webp)

![Nijashree Housing Scheme 2024 For LIG/MIG [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijashree-Housing-Scheme.webp)

![Hawker Support Scheme 2024: Eligibility and Benefits [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Hawker-Support-Scheme.webp)

![Nijo Griha Nijo Bhumi Scheme 2024 For Homeless People [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijo-Griha-Nijo-Bhumi.webp)

![West Bengal Gatidhara Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Gatidhara-Scheme-West-Bengal.webp)

![West Bengal Matsyajeebi Bandhu Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Bandhu-Scheme-in-West-Bengal.webp)

![Matsyajeebi Credit Card Scheme In West Bengal [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Credit-Card-Scheme-in-West-Bengal.webp)