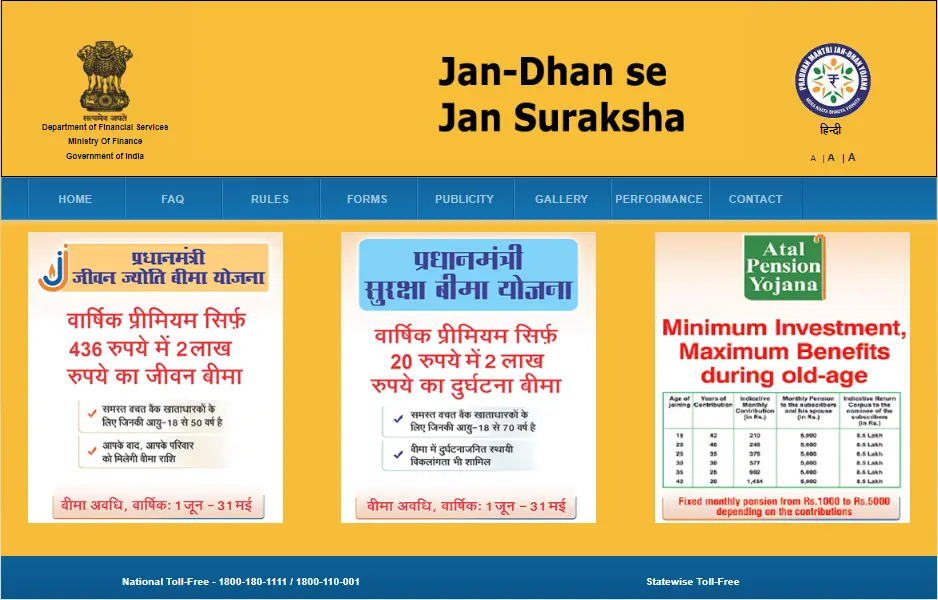

Pradhan Mantri Suraksha Bima Yojana | PM Suraksha Bima Yojana Apply Online | PMSBY 2023 Registration | Objectives & Eligibility

Not every citizen has the financial means to insure his or her security. Because private insurance companies charge a premium at higher rates for providing insurance. Keeping this in mind, the government runs a number of low-cost security insurance schemes. And, Pradhan Mantri Suraksha Bima Yojana is one of them. In today’s article, we will provide you with information about the PM Suraksha Bima Yojana online application, including its benefits, features, eligibility, and required documents.

Join our telegram group for getting the latest update regarding All Government Schemes and Yojana

Pradhan Mantri Suraksha Bima Yojana

The honourable prime minister Narendra Modi has launched the Pradhan Mantri Suraksha Bima Yojana on May 8, 2015. In this Bima, the applicant needs to pay a premium of 20 per year. If the person dies, the amount will be transferred to the nominee. However, in the case of permanent disability, the insurance amount is provided.

In case of an accident, this scheme provides insurance coverage ranging from ₹ 100,000 to ₹ 2,000,000. The benefits of the PM Suraksha Bima Yojana are only available to those between the ages of 18 and 70. Every year, before June 1st, the premium amount is deducted from the bank account. And the applicant must have the auto-debit feature enabled on their bank account to take advantage of this scheme.

Overview of the PM Suraksha Bima Yojana

| Scheme Name | Prime Minister’s Security Insurance Scheme |

| Initiated By | Prime Minister Shri Narendra Modi |

| Launch Date | The year 2015 |

| Beneficiary | Poor people of the country |

| Purpose | Providing accident insurance |

Objectives of the Pradhan Mantri Suraksha Bima Yojana

As you are aware, many people in the country are unable to obtain insurance because they are financially disadvantaged. When such a person dies in an accident, his entire family faces financial ruin. Aside from that, if they are unable to pay for any of the insurance plans offered by private or public sector insurance companies, they are all eligible for Suraksha Bima Yojana. If a person obtains accident insurance and dies, the amount insured by that person is paid to his family or nominee.

Benefits of the PM Suraksha Bima Scheme

- The people of all regions of the nation will receive benefits from this programme, but the people of the underdeveloped and impoverished regions will benefit the most.

- if someone perishes in a car crash or any other kind of accident. Therefore, the government will provide accident insurance for his family up to Rs 2 lakh.

- A cover of Rs. 1 lakh is offered in the event of permanent partial disability.

- In the event of an accident, he will receive up to one lakh rupees in insurance coverage.

- The policyholder needs to pay An annual premium of Rs 20 under the Pradhan Mantri Suraksha Bima Yojana. He won’t be eligible for security insurance until after that.

- They are also eligible for this scheme if they are unable to afford any of the insurance plans offered by private or public sector insurance companies.

- Every year, the Pradhan Mantri Suraksha Bima Yojana will renew with a one-year cover.

- The Bank may select any insurance company to provide this PMSBY.

- People in rural areas, in particular. The Pradhan Mantri Suraksha Bima Yojana ensures them.

Pradhan Mantri Suraksha Bima Yojana Premium & Its Rates

Members must pay a premium of 20 per year to receive the benefits of the Pradhan Mantri Suraksha Bima Yojana. According to the auto debit facility, this premium amount will be deducted from the account holder’s savings account on or before June 1. If the auto debit facility is not available on June 1st, the amount of the premium will be deducted from the account after the auto debit facility becomes available. The premium amount will also be reviewed based on annual claim experience.

Revision in Premium Rates

The Central Government has decided to revise the amount of premium under the PM Suraksha Bima Yojana. This plan will introduce new premium rates on June 1, 2022. The government introduced the Pradhan Mantri Suraksha Bima Yojana in 2015. The premium rates for this plan have not changed since then.

The government has raised the premium rate under this scheme by 1.25 per day. Beneficiaries of this scheme will now have to pay a premium of ₹20 instead of ₹20. These premium rates have been revised in light of the claim experience. This scheme had 22 crore active subscribers as of March 31, 2022.

| Insurance Status | Sum Insured |

| Death | 2 lakh rupees |

| Total and irrecoverable loss of both eyes or loss of use of both hands or feet or loss of sight of one eye and loss of use of one hand or foot | 2 lakh rupees |

| Total loss of sight in one eye and loss of use of one hand and foot | 1 lakh rupees |

PM Security Insurance Scheme Termination

The Suraksha Bima Yojana is available until the age of 70. If the beneficiary reaches the age of 70, the Pradhan Mantri Suraksha Bima Yojana will be terminated. PM Suraksha Bima Yojana will terminate if the beneficiary closes the bank account. However, if the beneficiary’s account does not have enough funds to cover the premium, the account will close under this scheme.

Apply for the Pradhan Mantri Suraksha Bima Yojana

Interested citizens of the country can apply for the Pradhan Mantri Suraksha Bima Yojana by visiting any bank branch.

- Visit the Prime Minister’s Security official website to download the Application Form.

- You must click on the “Forms” option on this home page.

- On the new page, select “Pradhan Mantri Suraksha Bima.”

- Next, select the “Application Form” option.

- The PDF will open, click to download and take a form printout.

- Now, fill up the form including name, address, Aadhaar number, email ID etc.

- Attach all the required documents and submit the form to the bank.

Eligibility Criteria for Applying the Scheme

- The applicant must be an Indian resident.

- The applicant must be between 18 and 70 years old to be eligible for the Pradhan Mantri Suraksha Bima Yojana.

- The candidate must have an active savings bank account.

- The applicant must sign a consent letter for the auto-debit of the policy premium.

- Every year on May 31st, all 20 premiums will be deducted at once.

- The policy will lapse if the bank account is closed.

- The policy cannot be renewed if the premium is not deposited.

Required Documents for the PM Suraksha Bima Yojana

- Aadhaar Card of the applicant

- Identity Card

- Bank Account Passbook

- Age Certificate

- I Certificate

- Mobile Number

- Passport Size Photo

Operation of the PM Suraksha Bima Yojana

The Pradhan Mantri Suraksha Bima Yojana carries some specific terms and conditions. Separately, the applicant can get the facilities of the data flow process and Amkheda Proforma. The bank will deduct the annual premium through auto-debit within the specified time frame. If you receive medicine, the insurance company may request that you fill out a nomination form. The insurance company may request these documents at any time.

Appropriation of premium under PMSBY

- Insurance premiums payable to the insurance company: ₹10 per year per member

- Business to BC/Micro/Corporate/Agent reimbursement: 1 per year per member

- Operating expense reimbursement to participating banks: one per year

Expiration of cover under PMSBY

- Anyone can apply for PMSBY upto 70 years of age.

- If the beneficiary’s bank account has insufficient funds to cover the premium.

- If a member is registered under the scheme with more than one account and the insurance company receives a premium, the insurance cover will be limited to one account and the premium may be forfeited.

- If no premium is paid by the due date, the insurance coverage ends.

Check the Application Status of the PM Insurance Scheme

- You must go to the official website.

- On the home page, click the “view application status” link.

- Now, you must enter the Application Number.

- Then, press the “Search” button.

- You can see the application status on your screen.

Check the Beneficiary List

- Visit the official website of the Pradhan Mantri Suraksha Bima Yojana.

- On the home page, click on the Beneficiary List link.

- A new page will appear, prompting you to select your state.

- Now you must choose your district.

- Now, you must select your block.

- A list of beneficiaries will appear on your screen.

Terms & Conditions of the Pradhan Mantri Suraksha Bima Yojana

- The Pradhan Mantri Suraksha Bima Yojana has a one-year duration.

- Every year, the scheme will renew.

- Accident Insurance Scheme will provide insurance coverage in the event of death due to an accident or disability.

- Initially, this scheme will be available through public-sector general insurance companies.

- Participating banks may hire any such general insurance company to carry out the scheme for their customers.

- Beneficiaries must be between the ages of 18 and 70 to be eligible for this scheme.

- If a person has more than one savings account, only one of them can benefit from this scheme.

- The insurance period is from 1st June to 31st May.

- The applicant can only benefit from the scheme after paying the annual premium.

- If the beneficiary of this scheme leaves the scheme for any reason, he can still benefit from it in the future by paying the premium.

Contact Information

If you are still having problems, you can call the helpline number to get assistance. The phone number for the helpline is 18001801111/1800110001.

Frequently Asked Questions

You can get two lakhs of insurance for just Rs.20 per year. If you are looking for low-cost insurance, this could be a good option for you.

PMSBY is a Central Government scheme in which the account holder receives a Rs 2 lakh insurance cover for just Rs 20.

By getting in touch with any affiliated bank or insurance provider, you can sign up for PMSBY on your own. You can also download the PMSBY form from the government’s Jan Suraksha website.

Important Links

| Join Telegram Group | CLICK HERE |

| Visit Official Website | CLICK HERE |

| Online Form Download | CLICK HERE |

Related Article:

- Karnataka Arundhati Scheme 2022: Overview, Benefits, Eligibility & Apply Online

- National Means-Cum-Merit Scholarship Scheme 2022: Eligibility Criteria & Application Process

- WB Primary TET Exam 2022: Eligibility, Apply Online, Exam Date, & Admit Card

- Uttar Pradesh Mathrubhumi Yojana 2022: Online Registration, Benefits, and Procedure to Apply

- E-Shram Card Yojana 2022: Overview, Benefits, And Online Apply for E-Shram Card

Join our telegram group for getting the latest update regarding All Government Schemes and Yojana

![PM Sahaj Bijli Har Ghar Yojana: Saubhagya 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/04/PM-Sahaj-Bijli-Har-Ghar-Yojana.webp)

![Nijashree Housing Scheme 2024 For LIG/MIG [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijashree-Housing-Scheme.webp)

![Hawker Support Scheme 2024: Eligibility and Benefits [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Hawker-Support-Scheme.webp)

![Nijo Griha Nijo Bhumi Scheme 2024 For Homeless People [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijo-Griha-Nijo-Bhumi.webp)

![West Bengal Gatidhara Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Gatidhara-Scheme-West-Bengal.webp)

![West Bengal Matsyajeebi Bandhu Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Bandhu-Scheme-in-West-Bengal.webp)

![Matsyajeebi Credit Card Scheme In West Bengal [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Credit-Card-Scheme-in-West-Bengal.webp)