Atal Pension Yojana | Atal Pension Scheme Registration | Apply online for APY 2023 | Eligibility, Benefits, Application Form & APY Chart

The Prime Minister of our country, Narendra Modi, launched the Atal Pension Yojana on June 1, 2015. Pension is offered after the age of 60 through the Atal Pension Yojana. To be eligible for this scheme, the beneficiary’s age must be in between 18 years to 40 years. This scheme provides beneficiaries with a monthly pension of ₹ 1,000 to ₹ 5,000. The amount of the pension depends on the beneficiaries’ investments and their age. Apart from that, the beneficiary’s family will get the benefit of the scheme in case of premature death. In this article, we will tell you all the details regarding Atal Pension Scheme. So, read till the end.

Join our telegram group for getting the latest update regarding All Government Schemes and Yojana

Atal Pension Yojana 2023

The person who applies for this scheme must deposit the premium every month. After that, when the applicant reaches the age of 60, the government will provide financial aid in the form of a monthly pension. Beneficiaries must be between the ages of 18 and 40 to apply for the Atal Pension Yojana. If a beneficiary is under the age of 18, he must pay a monthly premium of Rs 210, while those over the age of 40 must pay a monthly premium ranging from Rs 297 to Rs 1,454.

More than 65 lakh persons have so far enrolled in the Atal Pension Yojana. According to the Ministry of Finance, the number of clients has risen to 3.68 crores. As a result, the asset under management has grown to Rs 20,000 crore. Males account for 56% of total clients, while females account for 44%. The Chairman of the PFRDA has stated that a target of one crore enrollments has been set for this year.

Overview of the Atal Pension Scheme

| Scheme Name | Atal Pension Yojana |

| Launched Year | 2015 |

| Initiated By | The central government |

| Beneficiary | People from the unorganized sector of the country |

| Objective | Provide pension |

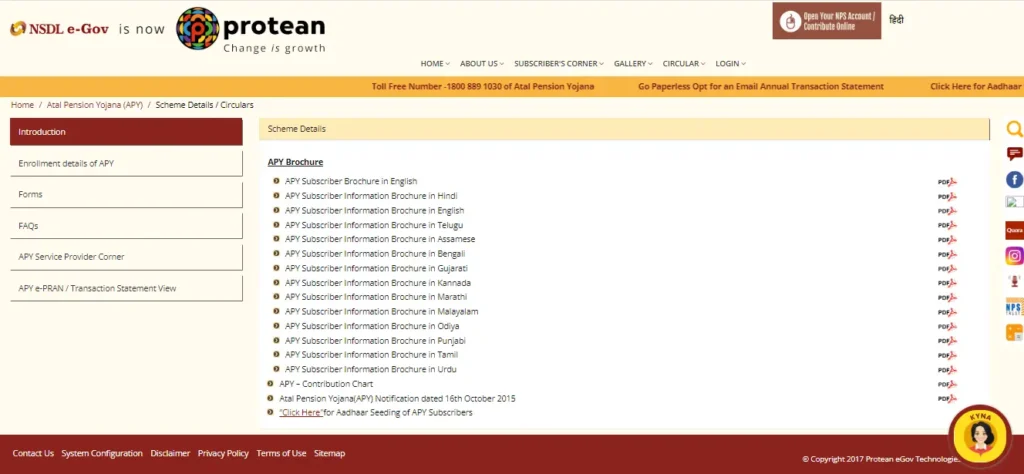

| Official Website | https://www.npscra.nsdl.co.in/scheme-details.php |

Objectives of this Pension Scheme

The primary goal of this scheme is to protect the future and make individuals self-sufficient by providing pensions to workers in unorganized sectors. It is a social security plan whose goal is to give social security to those who join the scheme. People must be empowered through the PM Atal Pension Yojana.

How to Apply for the Atal Pension Yojana?

- Open a savings account at any nationalized bank before applying for the Pradhan Mantri Atal Pension Yojana if you’re interested.

- After that, complete the Pradhan Mantri Atal Pension Yojana application form with all the necessary details, including your Aadhaar card and phone number.

- Fill out the application and give it to the bank manager. Your bank account will then be opened under the Atal Pension Yojana following the verification of all of your letters.

Atal Pension Scheme Enrolment & Payment

- After enabling auto deduction in their accounts, all eligible citizens can join the Atal Pension Yojana.

- To avoid a late payment penalty, the account holder must keep the required balance in his savings account on the due date.

- Only based on the initial contribution payment must monthly contributions be paid.

- If the recipient fails to make the payment on time, the account will be terminated, and all contributions made by the Government of India would be forfeited.

- If the account holder provides incorrect information in order to benefit from this plan, the government contribution will be forfeited together with penal interest.

- Aadhaar cards are required to get profit from this scheme.

- Pensions ranging from ₹ 1,000 to ₹ 5,000 are available to beneficiaries. which the recipient must promptly submit his contribution.

- Additionally, the beneficiary has the option of changing the pension amount.

- Only in the month of April is the pension amount subject to change.

- Each subscriber will receive an acknowledgement sheet after enrolling in the Atal Pension Yojana, on which the assured pension amount, the due date for contribution payment, etc. will be noted.

APY Enrolment Agency

- As POPs or aggregators, banks may appoint BCs/existing nonbanking aggregators, micro insurance agents, and mutual fund agents as enablers for operational activities.

- The bank may split the PFRDA/Government incentive with them.

- The Pension Fund Regulatory and Development Authority manages the scheme.

- The NPS institutional structure will be utilized to enrol subscribers in APY.

- PFRDA will develop the offer document for the Atal Pension Yojana, as well as the account opening form.

Total Number of Enrolment in the APY Scheme

The Atal Pension Yojana has opened 99 lakh accounts up to March 2022. Following that, the total number of accounts under this scheme reached 4.01 crore. Enrollments through public sector banks accounted for 71% of total enrollments, while regional rural banks accounted for 19%, private sector banks accounted for 6%, and payment and small banks accounted for 3%.

Out of the total enrollment completed till March 31, 2022, 80% of account holders chose the Rs.1000 pension plan, while 13% chose the Rs.5000 pension plan. 44% of total subscribers are female, while 56% are cyber males. 45% of account holders are aged 18 to 25.

Total Number of Beneficiaries Getting Benefits of APY

On February 8, 2022, information was submitted to Parliament indicating the number of subscribers to the Atal Pension Yojana has surpassed 71 lakhs as of January 24, 2022. The scheme was started in May 2015 with the goal of creating a universal social security system for the beneficiaries.

The Pension Fund Regulatory and Development Authority manages the APY scheme. During the financial year 2021-22, the number of beneficiaries under this scheme climbed to 71,06,743. This scheme had 68,83,373 and 57,12,824 customers in the financial years 2020 & 2019 respectively.

Benefits of the Atal Pension Yojana

- The Central Government will grant a monthly pension ranging from Rs 1000 to Rs 5000 under the Atal Pension Yojana only beyond the age of 60.

- The amount of pension paid under the Atal Pension Yojana will be determined by the beneficiaries’ investment and age.

- The government would contribute to this pension scheme in the same way that it does to the PF account.

- If you want a monthly pension of 1000 rupees and you are 18 years old, you must pay a premium of 210 rupees for 42 years.

- Whereas, people of age 40 years have to pay between Rs. 297 to Rs. 1,454 as a premium to get the benefit of the APY.

Required Documents for Applying the APY Scheme

- The applicant must be an Indian citizen.

- The age of the candidate should be in between 18 years to 40 years.

- The applicant should have a bank account and must link with the Aadhaar card.

- Aadhaar Card

- Identity Card

- Permanent Address Proof

- Mobile Number

- Passport Size Photo

Changes in Atal Pension Yojana

The Central Government’s Atal Pension Yojana for persons working in the unorganized sector has undergone significant changes.

Income Tax Payer is unable to get the Benefit

The Finance Ministry has announced that income taxpayers will no longer be eligible to participate in this plan. These regulations will go into effect on October 1, 2022. A citizen who is or has been a legal income taxpayer is not eligible to apply for the Atal Pension Yojana 2023, according to the new provision.

Tax Benefits

Customers will now receive tax breaks under this plan. The Pension Fund Regulatory and Development Authority shared the information in a tweet. According to this tweet, all income taxpayers between the ages of 18 and 40 can make use of this scheme and the income tax deductions provided under section 80CCD (1b) of the Income Tax Act. You may also benefit from contributions.

Contribution through UPI

The Pension Fund Regulatory and Development Authority PFRDA has launched a new service for Atal Pension Yojana account holders. According to this feature, NPS account members can now make contributions using the UPI Unified Payment Interface. Previously, NPS account users could only deposit their contributions using net banking. Contributing to the National Pension Scheme will now be easier thanks to this new facility. Because the UPI payment system is a “real-time payment mechanism”. The account holder can move money from one account to another in a matter of minutes using this method.

How to Make Payments through UPI

- Visit the National Pension Scheme’s official website.

- Then you must provide your PAN number.

- An OTP will be sent to your registered mobile number and email address, which you must enter.

- Then you must select either NPS Tier 1 or NPS Tier 2.

- Now, select Virtual Account VA.

- Your bank application will then be sent, and you will be given an acknowledgement number.

- You must now choose the UPI payment option.

- Following that, you must input your virtual account number as well as your UPI number.

- Make your payment now by inputting your UPI PIN.

- You can make payments through UPI under the National Pension Scheme in this manner.

Atal Pension Yojana Transaction Details

You are all aware that the Atal Pension Yojana was established for citizens in unorganized sectors. It is a type of retirement plan. This system requires beneficiaries to pay a premium. The government has now launched the Atal Pension Yojana smartphone application. Beneficiaries of the Atal Pension Yojana can now verify the last five deposits for free using this smartphone application.

In addition, transaction information and e-PRAN can be obtained. Beneficiaries can also examine their transaction data by visiting the Atal Pension Yojana’s official website. They must log in by going to this webpage. They must provide information about their PRAN and savings bank account. If there is no PRAN number, the beneficiary can log in using his name, account number, and date of birth.

Section 80CCD (1) of the Income Tax Act of 1961 provides for a tax credit under this plan. Transaction amount, the total holding of member money, transaction information, and so on may also be viewed through Umang App under Atal Pension Yojana.

Default Fee under Atal Pension Yojana

| For contributions up to ₹100 per month | ₹1 |

| For contribution of ₹101 to ₹500 per month | ₹2 |

| For contribution of ₹501 to ₹1000 per month | ₹5 |

| For contributions above ₹1001 | ₹10 |

How to View APY e-PRAN/Transaction Statement

- Go to the official Atal Pension Yojana website.

- On the home page, choose View APY e-PRAN/Transaction Statement.

- You must select your category and enter the captcha code on this page.

- Following that, you must provide the required information.

- You must now select Submit.

- You can see the appropriate data on your computer screen.

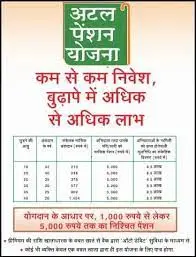

APY Contribution Chart

| Age of entry | Years of contribution | First Monthly pension of Rs.1000/- | Second Monthly pension of Rs.2000/- | Third Monthly pension of Rs.3000/- | Fourth Monthly pension of Rs.4000/- | Fifth Monthly pension of Rs.5000/- |

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 224 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

| 40 | 20 | 291 | 582 | 873 | 1164 | 1454 |

How to Download APY Chart?

- Visit the NSDL’s official website.

- On the home page, click on the link for the APY contribution chart.

- The Contribution Chart will appear in front of you as soon as you click on this link.

- This chart contains information on the contributions.

- You may also make this chart your friend by downloading it.

Pension Withdrawal

- After reaching the age of 60, the subscriber may withdraw from the Atal Pension Yojana. In this case, the pension will be provided to the subscriber following the withdrawal of the pension.

- If the subscriber dies, the pension amount will be paid to the subscriber’s spouse. If both of them die, the pension corpus will be returned to their nominee.

- Withdrawal from the Atal Pension Yojana is not permitted before the age of 60. However, the department allows use in specific extreme cases. For example, in the event of the beneficiary’s death or a terminal illness.

Get Receiving Information

- To begin, visit the official website of the Atal Pension Yojana.

- After that, select “APY Service Provider Corner” on the homepage.

- A new page will open with the information on the service provider.

Frequently Asked Questions

On May 9, 2019, the Atal Pension Yojana (APY) was launched to build a universal social security system for all Indians, particularly the impoverished, underprivileged, and workers in the unorganized sector.

The Atal Pension Yojana scheme provides no insurance benefits. This scheme is for workers in the unorganized sector (maid, gardeners, drivers etc.). It allows employees to save money for their retirement while still working and ensures returns for their retirement.

Atal Pension Yojana benefits can be obtained from any bank or post office in the country. In the event of the subscriber’s death, the benefit of the scheme is transferred to his nominee.

According to the new Atal Pension Yojana 2023 provision, a citizen who is or has been a legitimate income taxpayer is unable to enrol for this plan.

Important Links

| Join Telegram Group | CLICK HERE |

| Visit Official Website | CLICK HERE |

Related Article:

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) 2023

- Pradhan Mantri Suraksha Bima Yojana: PMSBY 2023

- Pradhan Mantri Shram Yogi Mandhan Yojana: PMSYM Yojana 2022

- Railway RCF Apprentice Recruitment 2023: 550+ Vacancies

- UP B.ED Admission 2023 Notification Out – Apply Now

Join our telegram group for getting the latest update regarding All Government Schemes and Yojana

![PM Sahaj Bijli Har Ghar Yojana: Saubhagya 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/04/PM-Sahaj-Bijli-Har-Ghar-Yojana.webp)

![Nijashree Housing Scheme 2024 For LIG/MIG [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijashree-Housing-Scheme.webp)

![Hawker Support Scheme 2024: Eligibility and Benefits [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Hawker-Support-Scheme.webp)

![Nijo Griha Nijo Bhumi Scheme 2024 For Homeless People [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijo-Griha-Nijo-Bhumi.webp)

![West Bengal Gatidhara Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Gatidhara-Scheme-West-Bengal.webp)

![West Bengal Matsyajeebi Bandhu Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Bandhu-Scheme-in-West-Bengal.webp)

![Matsyajeebi Credit Card Scheme In West Bengal [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Credit-Card-Scheme-in-West-Bengal.webp)

![West Bengal Sabla Scheme To Empower Adolescent Girls [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/01/West-Bengal-Sabla-Scheme.webp)