ESIC Scheme 2023 | Employee’s State Insurance Scheme | Employee State Insurance Scheme Benefits, Eligibility, Features | Apply for Government of India’s ESI scheme

The Employees State Insurance Corporation is the administrator of the ESIC Scheme, which combines health and social security benefits. The Indian government, working with the Parliament, passed the Employees State Insurance Act in 1948 to improve worker social security in the newly independent nation. The 1950s Industrial Revolution saw a large increase in worker hiring as a means of expediting manufacturing processes.

Giving these large numbers of workers a safety net was the intention of the law, especially in the case of medical emergencies. Three years of unemployment insurance, staggered payouts in the event of an unfortunate event, and 26 weeks of maternity coverage are just a few of the many benefits provided by this program. In this article, we will tell you all the details regarding the ESI scheme.

Join our telegram group to get the latest updates regarding All Government Schemes and Yojana

Employee State Insurance Scheme (ESIC Scheme)

A multifaceted social security program, the Employee State Insurance Scheme seeks to offer socio-economic protection to individuals and their dependents who work in the organized sector. This insurance plan provides financial assistance to individuals in the event of an illness, pregnancy, or medical emergency resulting from industrial hazards.

The corporate body in charge of overseeing the administration of this integrated ESIC Scheme is the Employee State Insurance Corporation. This plan is governed by the Employees’ State Insurance Act, which requires all businesses to ensure that a new hire is enrolled in this program.

Overview of the ESI Scheme 2023

| Name | ESIC Scheme |

| Managed by | Employees State Insurance Scheme |

| Objective | Lessen the financial strain brought on by health-related contingencies |

| Beneficiaries | Employees |

| Official Website | https://esic.gov.in/ |

ESIC Scheme 1948 Act

The Parliament published the 1948 Employees’ State Insurance Act, or ESI Act, the country’s first major social security law after independence. The ESI Act of 1948 provides medical insurance and other essential benefits to workers and employees who work in businesses, factories, hotels, road transportation, movie theaters, newspapers, educational or medical institutions, and shops with ten or more employees.

The ESI system offers benefits to workers and their dependents in the event of any unfortunate events at work. Under the ESI Act, workers who fall into one of the aforementioned categories and make up to Rs. 21,000 a month are eligible for this social security program. To protect people from poverty, squalor, and social degradation and to preserve their dignity in times of crisis, the ESI Act was created.

ESIC Scheme Contribution Rates

| Employee’s Contribution Rate | 0.75% of the total wage |

| Employer’s Contribution Rate | 3.25% of the total wage paid to the employees |

ESIC Scheme Contribution Period

| Contribution Periods | 1st April-30th September 1st October-31st March |

| Cash benefit Periods | 1st January-31st June 1st July-31st December |

Purpose of the Employees State Insurance Scheme

The main objective of the Government of India’s Employee Savings Insurance (ESI) scheme is to safeguard workers against certain health-related calamities, like illness, injury, or death resulting from an occupational disease or accident that limits the worker’s capacity to earn a living or causes income loss. Through this program, employees can alleviate some of the financial burden that these unfortunate circumstances cause. Additionally, the program offers maternity benefits to its participants.

Features of the ESIC Scheme

- The Employee State Insurance Scheme is designed to cover all workers whose monthly salary is less than or equal to Rs. 21,000.

- Currently, employers must contribute 3.25% of payroll, and employees must contribute 0.75%. The government reduced the total payment from 6.5% to 4% in 2019. Note that if an employee’s daily wage is less than Rs. 137, they are released from paying their share.

- For specific conditions, the insurer and their dependent family members may be eligible for medical benefits.

- All past-due contributions must be paid by employers within the first 21 days of the month.

- State governments must pay 1/8th of all medical expenses up to Rs. 1500 per person under the ESI program.

- The plan will continue to pay benefits to an insured individual even if they decide to enroll in the VHS plan or take an early retirement.

- In an effort to provide better patient care, the program advocates for the opening of additional medical schools.

- Even in the event of unemployment, program benefits may be continued for a maximum of three years. They must, however, enclose their letter of termination as well as any pertinent details regarding their prior employer.

- When a female employee is dealing with pregnancy-related issues, she receives additional benefits. Without changing their pay scale, they are able to extend their 26-week maternity leave by an additional month.

- This plan accounts for mishaps that happened while traveling because of hazards associated with work.

Benefits of the ESI Scheme

| Medical | Affordable and reasonable healthcare facilities cover the insured’s medical expenses as part of the plan. Furthermore, from the beginning of their employment, the worker or employee is protected. |

| Disability | A worker who sustains a temporary disability is entitled to receive 90% of their monthly wage while they recover. In the event of a permanent impairment, one may use 90% of the monthly salary for the remainder of their life. |

| Maternity | On a doctor’s recommendation, the program beneficiary may receive an additional month of pay in addition to 100% of the daily pay for a maximum of 26 weeks. In cases of miscarriage, the benefit lasts for six weeks; in cases of adoption, it lasts for twelve. |

| Dependents | If the insured gets sick or has an accident at work, the plan provides financial support for the insured’s dependents. In these situations, dependents are eligible for monthly payments, which are distributed equally among the surviving dependents. |

| Sickness | In the event of a medical leave of absence, the plan provides cash flow. The employee is entitled to 70% of the daily wage for a total of 91 days. You can use this for two consecutive periods of time. |

| Unemployment | For a maximum of 24 months, the scheme offers up to 50% of the average monthly wage in the event of an injury-related permanent disability or an involuntary loss of employment. |

Eligibility Criteria for Applying the ESI Scheme

To apply for the Employee State Insurance Scheme, you must fulfill the following eligibility requirements:

- He or she must work for a non-seasonal company that employs at least ten people.

- A worker’s monthly salary should be at least Rs. 21,000.

How to Register for ESIC Scheme 2023?

The user must take the actions listed below to register for the ESIC scheme.

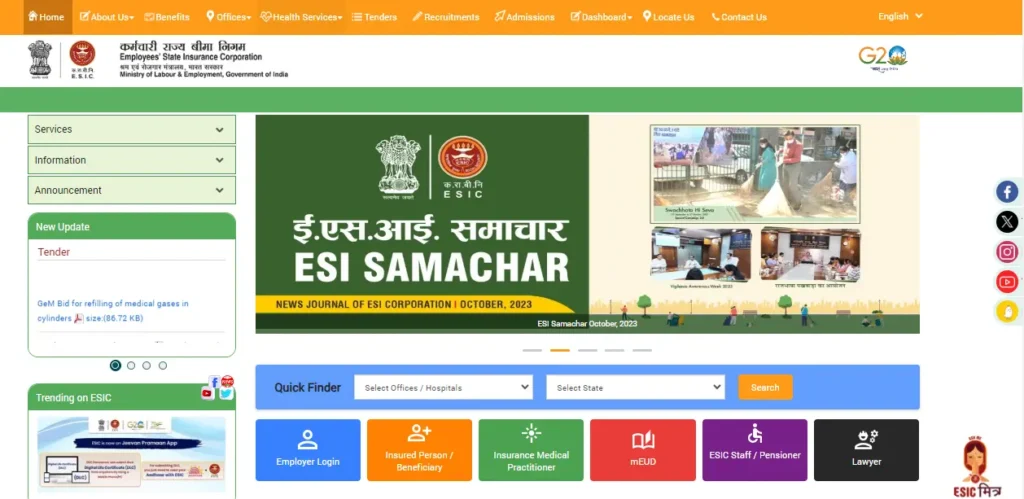

- Firstly, visit the official website of ESIC.

- On the home page, click on the “Sign-Up” button.

- The sign-up form will appear on the display.

- Now, complete the form with all the necessary information, including your name, email address, employer’s name, mobile number, region, and state.

- To verify all the information about your company, check the box.

- After that, enter your email address and click the Submit button to get your login information.

- Proceed to sign in to the ESIC portal with your login details.

- After logging in successfully, select the option labeled “New User Registration.”

- The screen will open where you need to enter the name of your unit, your factory’s address, and the closest police station.

- Next, select the Next button.

- Enter the business’s nature and category. Next, enter the date the business was founded.

- Choose the ownership structure and the specifics of the ownership.

- Next, list all of the workers in your factory as well as the number of workers whose monthly salary is less than 21,000 rupees.

- Click the “Save” button.

- Continue and enter the date that the company hired its first ten employees. Next, select the Employee Declaration Form.

- Next, provide the IP’s name, birthdate, father’s name, gender, family information, marital status, and joining date.

- Click the “Submit” button.

- A new page will appear, choose the inspection division and branch office of ESI now.

- Next, click the “Submit” button.

- Next, select the “Pay Initial Contribution” option.

- To complete the payment, move on and click the Continue button.

- The registration process will be finished as soon as the payment is done.

Documents Required for ESI Scheme Registration

- In the case of a company or partnership, the Certificate of Registration

- The Registration Certificate obtained in accordance with the Factories Act or the Shops and Establishment Act

- A list of every person employed by the company

- The company’s articles of association and memorandum of association

- PAN Card information for each employee and the business entity.

- information about each employee’s compensation.

- List of the company’s directors and shareholders

- Refund of the company’s bank account check

- Together with the aforementioned documents, you must download, complete, and upload the Employer’s Registration Form (Form No. 1) to the ESIC website.

- A register with the employees’ attendance information.

How to Login to the ESIC Portal?

The user must take the actions listed below to log into the ESIC Portal:

- Firstly, visit the official website of ESIC.

- Select the “Employee/Insured Login” on the homepage.

- The login page will open, enter your login ID, password, and the captcha code.

- Next, click on the “Login” option to access your registered account.

Reason for ESIC Scheme Requirement

A company, organization, or business institution must register for ESI if it employs ten or more people, or twenty or more in Chandigarh and Maharashtra. It is necessary for the business to register with the ESIC. Workers or employees are eligible for coverage under the ESI if their monthly income is less than Rs. 21,000 (or Rs. 25,000 in the case of a disabled individual).

The employer matches 4.7 percent of the employee’s wage, with the employee contributing 1.75 percent. Please be advised that there may be sporadic changes to these prices. Employers will still make contributions to the ESI fund on behalf of their employees, even if the employees’ daily average pay is less than Rs. 50.

| ESIC Covers | ESIC Doesn’t Cover |

|---|---|

| The list of businesses now included in the program is restaurants, lodging facilities, shops, movie theaters and preview rooms, newspapers, hotels, and road-motor transport firms. | The employee state insurance program does not cover workers who earn 21,000 rupees or more per month. |

| It is accessible to more than 3.49 crore Indian families and individuals as of March 2021. | States like Chandigarh and Maharashtra permit up to 20 employees to be covered under the ESIS program, while the remaining states and Union Territories cap coverage at 10 employees. |

| organizations that provide private healthcare and education and employ ten people or more. Note that this is applicable to a very small number of states and union territories. | Individuals with disabilities who earn 25,000 rupees or more per month are ineligible for coverage under ESIS. |

| We have informed the government that ESIS insurance, in accordance with Section 1(5), provides coverage for dining establishments and retail stores. |

Contact Details

If you have any additional questions about the ESIC Scheme, please contact us using the information below.

| ESI Head Office | Employees’ State Insurance Corporation, Panchdeep Bhawan, Comrade Indrajeet Gupta (CIG) Marg, New Delhi – 110002 |

| Mobile Numbers | 011 – 23234092 / 23235496 / 23234093 / 23234098 / 23236998 / 23236051 / 23235187 |

| Medical Helpline | 1800-11-3839 |

| Toll-Free/ Help Desk Number | 1800-11-2526 |

| E-Mail Address | IT Related Issues: itcare@esic.nic.in Grievances/Suggestions: pg-hqrs@esic.nic.in |

Important Links

| Join Telegram Group | CLICK HERE |

| Official Website | CLICK HERE |

Related Articles:

- Senior Citizen Saving Scheme (SCSS) 2023 – Eligibility, Interest Rate & Benefits

- Kutumb Pension Yojana 2022: Family Pension Scheme, Eligibility Criteria, Application Process

- Mahadbt Scholarship 2023 – Apply before the Last Date on mahadbtmahait.gov.in

- PM Atmanirbhar Swastha Bharat Yojana – Scheme Details, Eligibility criteria, Application Process

- MP Vridha Pension List 2023 Check: Madhya Pradesh Old Age Pension Scheme

Join our telegram group to get the latest updates regarding All Government Schemes and Yojana

![PM Sahaj Bijli Har Ghar Yojana: Saubhagya 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/04/PM-Sahaj-Bijli-Har-Ghar-Yojana.webp)

![Nijashree Housing Scheme 2024 For LIG/MIG [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijashree-Housing-Scheme.webp)

![Hawker Support Scheme 2024: Eligibility and Benefits [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Hawker-Support-Scheme.webp)

![Nijo Griha Nijo Bhumi Scheme 2024 For Homeless People [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijo-Griha-Nijo-Bhumi.webp)

![West Bengal Gatidhara Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Gatidhara-Scheme-West-Bengal.webp)

![West Bengal Matsyajeebi Bandhu Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Bandhu-Scheme-in-West-Bengal.webp)

![Matsyajeebi Credit Card Scheme In West Bengal [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Credit-Card-Scheme-in-West-Bengal.webp)

![West Bengal Sabla Scheme To Empower Adolescent Girls [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/01/West-Bengal-Sabla-Scheme.webp)