Sukanya Samriddhi Yojana – A scheme for girls under ‘Beti Bachao Beti Padhao’ campaign

One of the most successful initiatives to help female children save their lives and receive financial support is the Sukanya Samriddhi Yojana (SSY).

Sukanya Samriddhi Yojana is a scheme that is a journey to save every girl’s child. Narendra Modi started it under the scheme of the Beti Bachao Beti Padhao campaign, which is a process that will help to secure the life of a girl child. Read the entire article to know all the benefits of the Samriddhi Yojana.

This is a central government scheme that will secure every girl child’s life in India by giving monetary assistance to their family. Here the family having a girl child should have to make a one-time investment, and after the age of 21 years, they will be able to mature the Yojana, and they will get a maximum amount that they can use for their girl child. If needed, they can also use this money for higher studies.

SSY – Sukanya Samriddhi Yojana At A Glance

| SSY Started By | PM Narendra Modi |

| SSY Scheme operated by | Central Government of India |

| Name of the campaign | Beti Bachao Beti Padhao |

| SSY Account opening minimum age | 10 Years |

| Interest Rate | 7.60% per annum |

| Investment Amount | Minimum Rs 250 Maximum Rs 1.5 lakh per annum |

| Maturity Period | 21 years from account opening or till the marriage after 18 years of age |

The Central Government has reduced the interest rate of the SSY account from 8.4% to 7.6%. The tax benefit of the Yojana is almost Rs.1.5 lakh. The account will also be transferred, and the investment can be made for the marriage and education of the child.

Additionally, the child’s family may open an SSY account at any bank or post office that is convenient for them.

Read his article to know more about the Sukanya Samriddhi Yojana. There are several calculators available, the help of which you will be able to calculate the Sukanya Samriddhi Yojana benefits and get the maximum benefits from the Yojana for your girl.

Benefits of the Sukanya Samriddhi Yojana

When people open an account, they will be able to get more than one benefit that could help them operate their account and other help.

Operation of the account

The guardian of the girl child or the parent of the girl child will be able to use the account until the girl child reaches ten years. If she is not able to operate the account, he should have to operate the account when she reaches above 18 years.

Deposit details

The central government published an official announcement stating that deposits into a financial account must be between Rs. 500 and Rs. 1.5 lakh, minimum and maximum amounts. It is necessary to deposit in multiples of 100 rupees.

Duration of the scheme

The deposit should be made for at least 15 years, and the scheme will mature after almost 21 years.

Transferring the SSY account

Transferring the Sukanya Samriddhi Yojana is also not a tough task; the user will be able to transfer the account from post offices to the banks and vice versa from any part of India. To transfer the account, none of the charges will be counted, but they should have to give proof of the change of residence to be submitted to the bank or the post office.

People who are willing to change it without any proof should have to give a Rs. 100/- fine for the change. For this reason, you should have to transfer the account to the other section, and you will also not feel so hassled while transferring the account.

Mode of deposits

There are several deposit methods available by which the transactions can be made. With the help of a cheque, cash, online transfer, or demand draft, people can pay for the deposit of the account.

How to Apply for Sukanya Samriddhi Yojana

By opening an SSY account in the bank, people will be able to make the application for the Sukanya Samriddhi Yojana. Here are the steps that you should have to follow so that you will be able to get the Yojana.

Suggested Article: Haryana Govt. Education Loan Scheme

- You need to visit the nearest branch of the bank where you will be able to apply for the account. You can also visit the post office to fill out the application form if you want.

- When you complete the filling up of the form, you should have to submit it with all of the necessary documents to get approval for the account.

- Now, you need to pay at least the first deposit of the amount, and the range of the deposit should be between Rs.250 and Rs.1 lakh.

- The Sukanya Samriddhi Yojana will begin once the post office or bank verifies that the application and payment details are accurate.

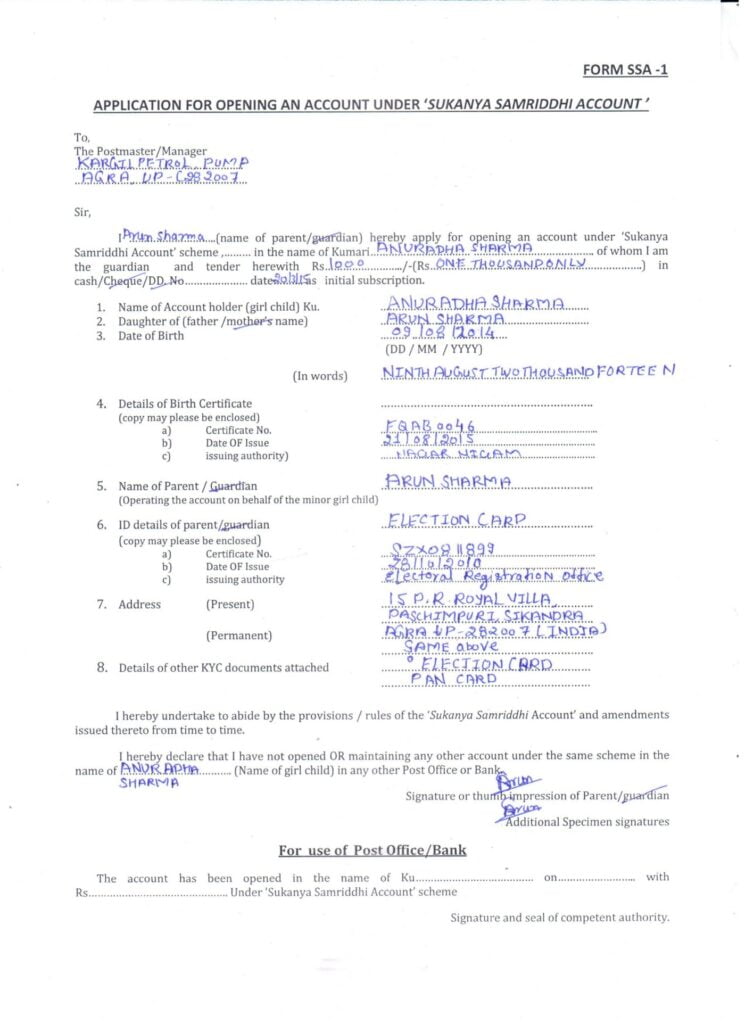

Filling up a form for the SSY account form of the post office

You can easily open an SSY account for your daughter from any nearest post office. Here is the process on how to fill out the SSY account form

- First, you need to visit the post office and ask for the Sukanya Samriddhi Yojana.

- Now, if you have a savings account in the post office, you need to provide your account number.

- Now, you need to mention the post office branch details along with the postal address under the section named To The Postmaster’.

- Now, you have to post the photograph of the applicant

- You must include the applicant’s name, refer to the program as “Sukanya Samriddhi Yojana,” and specify the amount and the creation date of the account.

- Next, you have to give the relevant details regarding the ‘Account Type’ and ‘Account Holder Type’.

- Fill up the form by giving relevant details like gender, Aadhaar number, PAN, address, etc.

- Next, you need to sign in to page 1 so that you will be able to authorize the information that is being provided.

- On page 2, section 5, you need to provide your details once you wish to provide instructions for the amount that you need to deposit to the bank account.

- Now, you need to check the square box next to the SSA, and you need to confirm that none of the other SSY accounts has been created until now.

- Provide the nomination details along with the date and signature, take help from two witnesses, and take their signatures.

- Give the date regarding the place, date, and signature at the end of the nomination form.

List of Banks for SSY Account:

- State Bank of India

- United Bank of India

- UCO Bank

- Punjab National Bank

- Oriental Bank of Commerce

- Indian Bank

- ICICI Bank

- Corporation Bank

- Canara Bank

- Bank of India

- Axis Bank

- Andhra Bank

- Allahabad Bank

- Vijaya Bank

- Union Bank of India

- Syndicate Bank

- Punjab & Sind Bank

- Indian Overseas Bank

- IDBI Bank

- Dena Bank

- Central Bank of India

- Bank of Maharashtra

- Bank of Baroda

For this reason, it is important to check the eligibility of the Yojana so that you will be able to make sure that you are eligible to open this account.

Eligibility Criteria for the Sukanya Samriddhi Yojana:

Below are the eligibility criteria for the Sukanya Samriddhi Yojana scheme.

- The parent or the legal guardian will be able to open an SSY account on behalf of the girl child until she turns 10.

- The Girl child should have to be a resident of India.

- In a family, two accounts for two girls can be opened for the twin girls, and people will be able to open a third account.

Documents required to open the SSY account

There are several documents that you may need to open the SSY account.

- The sukanya samrodhi yojana opening form

- When creating the account, you should attach the girl child’s birth certificate.

- Also, you should provide the ID evidence and the depositor’s address proof.

- The medical certificate must be filed if several children are born in the same order.

- Any other documents that should be there by the bank or the post office.

Suggested Article: How to Apply PM Kisan Samman Nidhi Yojana

How to withdraw an amount from SSY- Sukanya Samriddhi Yojana account

There are more than one steps that you have to provide so that you will be able to withdraw the amount from the bank, for the matured account, and the premature account. People should have to take help from these steps when they are willing to withdraw money from their accounts.

There are several withdrawal rules for the creation of the SSY.

The entire sum, along with the interests that the female child can withdraw, will remain available in the account after the account’s term is up. Here the girl child should have to provide these documents.

- They filled up the application form for the account closure and withdrawal of the amount.

- ID proof

- Address proof

- Citizenship documents

Withdrawal of the money will be allowed for the higher education of a girl child and the age of 18 years, and she has to complete the 10th exam at least. The money should be used for the fees or any other charges that should be provided during the time of admission.

Documents like the admission details of the university or the college and the fee receipt of it should be submitted. The amount should be withdrawn in almost five installments and a lump sum.

What happens if someone pays an excess or less amount to the Sukanya Samriddhi Yojana scheme?

When the user can pay the excess amount to the Sukanya Samriddhi Yojana, none of the interest will be generated for the excess amount. The investor can take back their excess amount at any time from the bank where they have opened their account.

In case of lesser payment, when the investor is not able to pay an amount of almost 500 rs in a financial year, the account will be marked as a default account, and by giving a 50 rs fine, the investor can bring it back to the active state.

Rules for premature withdrawal from SSY account

The rules are there to allow the premature closure of the account listed here.

- Once the girl reaches the age of 18 and gets married, only withdrawal is allowed. Next, the application must be submitted at least a month before the marriage or three months before the marriage will be legal. The age proof of the girl will be provided.

- When the girl child becomes a non-citizen person, the account will be automatically closed.

- If any girl child passes away during the scheme, the balance can be withdrawn by the guardian. In this case, the death certificate should be provided.

- After paying for five years or more, if the family fails to pay the amount, the family can opt for a premature closing. In other cases, you will be able to close the account, but in that case, the interest rate should be lower.

FAQ

Yes, the scheme is available all over India for every girl child in the nation.

A Guardian or a parent of a girl child can be able to open this account at the bank or the post office.

No, they will not be able to apply for the Yojana.

No, you will not be able to open an account online.

Yes, it looks like a recurring deposit. But it is a savings account.

![PM Sahaj Bijli Har Ghar Yojana: Saubhagya 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/04/PM-Sahaj-Bijli-Har-Ghar-Yojana.webp)

![Nijashree Housing Scheme 2024 For LIG/MIG [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijashree-Housing-Scheme.webp)

![Hawker Support Scheme 2024: Eligibility and Benefits [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Hawker-Support-Scheme.webp)

![Nijo Griha Nijo Bhumi Scheme 2024 For Homeless People [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijo-Griha-Nijo-Bhumi.webp)

![West Bengal Gatidhara Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Gatidhara-Scheme-West-Bengal.webp)

![West Bengal Matsyajeebi Bandhu Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Bandhu-Scheme-in-West-Bengal.webp)

![Matsyajeebi Credit Card Scheme In West Bengal [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Credit-Card-Scheme-in-West-Bengal.webp)

![West Bengal Sabla Scheme To Empower Adolescent Girls [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/01/West-Bengal-Sabla-Scheme.webp)