Pradhan Mantri Fasal Bima Yojana Registration | PM Fasal Bima Yojana Apply | Pradhan Mantri Fasal Bima Yojana Insurance | PM Fasal Bima Yojana

Pradhan Mantri Fasal Bima Yojna (PMFBY) was introduced by our honorable PM Narendra Modi in 2016 as a replacement for all the yield insurance schemes in India. The scheme aims to the adoption of technology for yield estimation and has extended coverage under localized risks, post-harvest losses, etc. Through low farmer premium rates and increased awareness, the scheme aims to increase crop insurance penetration in India.

Join our telegram group for getting the latest update regarding All Government Schemes and Yojana

Pradhan Mantri Fasal Bima Yojana Overview

| Article Category | Pradhan Mantri Yojana |

| Name of the Scheme | Pradhan Mantri Fasal Bima Yojana (प्रधान मंत्री फसल बीमा योजना) |

| Location | Across India |

| Launched on | 18th Feb 2016 |

| Launched by | PM Narendra Modi |

| Authority | Ministry of Agriculture and Farmers Welfare |

| Objective | To empower the farmers of the nation |

| Beneficiaries | Farmers of India |

| Last date to apply | Kharif- 31st July Rabi- 31st December |

| Mode of application | Online |

| Official Website | pmfby.gov.in |

Benefits of Pradhan Mantri Fasal Bima Yojana

Besides helping many farmers during unprecedented times of disasters, Pradhan Mantri Fasal Bima Yojana offers several benefits such as

- The farmers need to pay a very lower premium amount under the scheme.

- In case of crop failure, the farmers will be paid the partial or full amount of insurance.

- Under PMFBY, claiming the insurance amount becomes very easy online.

- The scheme helps in the upliftment of the agricultural people.

| State | Claims worth | Reasons |

| Andhra Pradesh | Rs. 500 Cr | Pre-sowing claims |

| Haryana | Rs. 100 Cr | 2018 hailstorm |

| Rajasthan | Rs. 30 Cr | 2019-20 locust attack |

| Maharastra | Rs. 5000 Cr | 2019 unseasonal rainfall |

Due to the immense trust of farmers in Pradhan Mantri Fasal Bima Yojana, a total of 24.68 lakh crop insurance applications have been registered on Saturday 16th July 2022. Now, check the details about the premium rates and the amount to be paid by the farmers.

| Season | Crop | Premium Charges to be paid by the Farmer |

| Rabi | Food grain and oilseed crops | 2% of the Sum Insured or Actuarial Rate |

| Kharif | Food grain and oilseed crops | 1.5% of the Sum Insured or Actuarial Rate |

| Rabi & Kharif | – Annual horticultural/ commercial crops – Perennial horticultural/ commercial crops | 5% of the Sum Insured or Actuarial Rate |

Objectives of Pradhan Mantri Fasal Bima Yojana

PM Fasal Bima Yojana is an initiative to promote sustainable crop production and help farmers from suffering severe crop loss due to natural calamities, such as droughts, inundation, heavy rainfall, floods, cyclones, and natural fire. Even the scheme claims to provide crop insurance to stabilize and recover the loss. Check out the major objectives of the PM Fasal Bima Yojana.

- The scheme offers financial aid to the farmers who are suffering from harsh and stern crop loss due to attacks by pests, diseases, and natural disasters.

- PM Fasal Bima Yojana encourages farmers to continue farming.

- PMFB Yojana provides opportunities to assure farmers’ stability in terms of finance.

- The scheme also promotes contemporary and modern techniques and methodologies for farming.

- This Crop Insurance Scheme ensures food security that aims to maintain the flow of credit in the sector.

Eligibility Criteria of PM Fasal Bima Yojana

- Under this scheme, all farmers including sharecroppers and tenant farmers should grow notified crops in the declared areas.

- Compulsory for Loanee farmers, availing seasonal agriculture operations (SAO) loans from financial institutes such as KCC holders, or Loanee farmers for the notified crops.

- The Scheme would be optional for the non-loanee farmers.

- All Food Crops like Cereals, Millets, Pulses, Oil seeds, Annual Commercial/Horticulture Crops.

Documents Required for Pradhan Mantri Fasal Bima Yojana

Interested farmers must have all the below-mentioned documents, authorized by the concerned signatory department.

- Farmer’s ID Proof

- Residential Proof

- Supporting Land Records

- Proof of crop sown in the field

- Canceled cheque

Registration Process of Pradhan Mantri Fasal Bima Yojana

All eligible farmers can apply for the Pradhan Mantri Fasal Bima Yojana from their official website. To register online for the scheme, check the below-given procedure.

- Visit the official website of Pradhan Mantri Fasal Bima Yojana.

- Search the “Farmer Corner” icon on the homepage and click on it.

- If you are new to registration, select the “Guest Farmer”.

- A new page will appear asking for your personal, residential, and account details. Fill up all the required details and click on the “Create User” button at the end of the page.

- After successful submission, the farmers can log in to their accounts and update their profiles by using their registered mobile numbers.

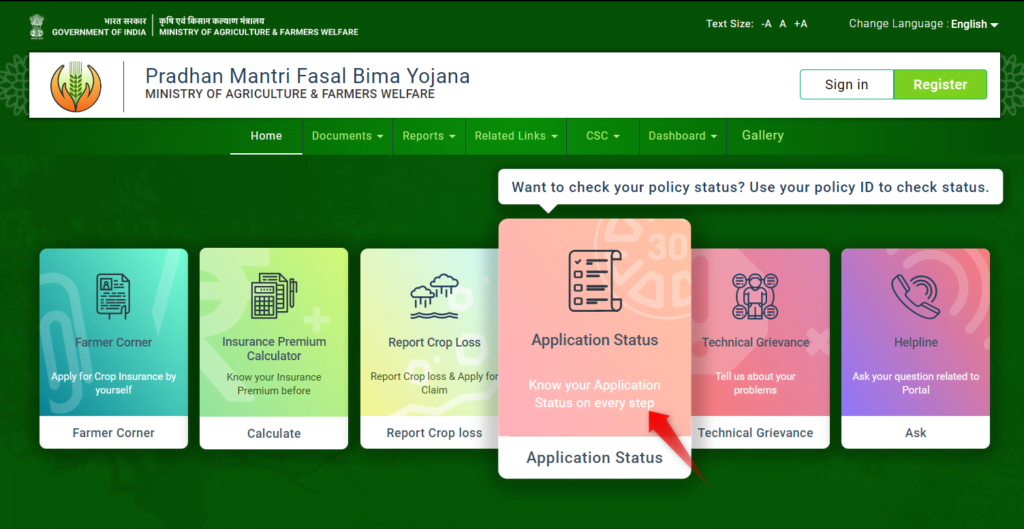

Check the Status of the PMFBY Application

The applicants can check their PM Fasal Bima Yojana application status online. The process is given below, check it out.

- Visit the official website of Pradhan Mantri Fasal Bima Yojana, and search for the “Application Status” icon.

- Click on the icon, and a dialogue box will open. Put your Receipt number and the captcha code to proceed.

- Now, click on the “Check Status” button and you can see the status of your application on the screen.

Coverage of PM Fasal Bima Yojana Crop Insurance Scheme

The scheme covers several types of risks described underneath.

Basic Cover

PMFBY covers basic risks like the loss of standing crops from sowing to harvesting due to unavoidable circumstances. The scheme claims to give insurance for natural calamities such as droughts, floods, natural fires, and pest attacks, crop diseases, etc. on the basis of the area affected.

Add-On Coverage

The State Government may or may not provide additional coverage based on the following steps of crop and dangers leading to the crop loss.

- Due to drastic climatic conditions, the insured area is restricted from sowing.

- If any seasonal climatic changes occur during the crop season, this scheme provides relief funds immediately.

- The scheme facilitates an instant insurance claim in case of any calamity within the two weeks of harvesting.

- Crop loss due to localized calamities, like heavy rainfall, hailstorm, lightning, etc.

- Crop loss due to attack by wild animals.

PM Fasal Bima Yojana Insurance Claim Calculator

The farmers can know their insurance premiums on the PM Fasal Bima Yojana portal. Check out the process to calculate it.

- Visit the official website of PMFBY, and click on the “Insurance Premium Calculator” icon.

- Select the season of the crop, type of the crop, year, applied scheme, and your state and district from their respective drop-down lists.

- Next, enter the area in hectares.

- Now, click on the “Calculate” button to check your insurance amount.

The system will generate the amount of insurance premium to be paid to the farmers under this PMFBY scheme.

Steps to claim PM Fasal Bima Yojana Insurance Amount?

Check the complete process to claim PM Fasal Bima Yojana Insurance Amount here.

- If there’s any damage, the farmers need to contact the state government, bank, or insurance company, and inform them about the crop loss within 72 hours.

- Next, your report will be forwarded to the concerned insurance company.

- A Damage Surveyor will occur within 72hours of reporting by the insurance company.

- The designated Damage Surveyor will check the agricultural site for the next ten days.

- If it is found genuine, the amount will be transferred to the farmer’s account within 15 days of the survey.

Pradhan Mantri Fasal Bima Yojana (PMFBY) Helpline

All the issues and queries related to the PM Fasal Bima Yojana and Crop Insurance Scheme will be resolved by the PMFBY officials. So, if you have doubts regarding the scheme, or any problem during processing the application, or others, contact the concerned authorities through their email or call the given toll-free number. Moreover, you can write your queries at help.agri-insurance@gov.in.

| Rakesh Ranjan | Mail ID: Rakesh.Ranjan@royalsundaram.in |

| Mrityunjoy Bhattacharya | Mail ID: Mrityunjoy.bhattacharya@royalsundaram.in |

| Toll-free number | 18604250000 |

PMFBY Important Links

| Join Telegram Group | CLICK HERE |

| Official Website of PMFBY | CLICK HERE |

| Revamped Guidelines of PMFBY | CLICK HERE |

| PMFBY Features – English | CLICK HERE |

| PMFBY Features – Hindi | CLICK HERE |

| PMFBY Tutorials | CLICK HERE |

SI = Scale of Finance (per hectare) X Notified crop area as proposed by the farmer for insurance.

(i) Food crops

(ii) Oilseeds

(iii) Annual/ perennial horticultural or commercial crops.

All the unforeseen circumstances that result in damage to crops are covered under the scheme from pre-sowing to post-harvesting stages.

The insured amounts are paid to the farmers via NEFT mode only.

You can contact the PMFBY official through their email: help.agri-insurance@gov.in

Related:

- PM Atmanirbhar Swastha Bharat Yojana

- How to Apply for Agniveer under Agnipath Scheme

- SSY-Sukanya Samriddhi Yojana

- PM Kisan Samman Nidhi Yojana

- Pradhan Mantri Awas Yojana

Join our telegram group for getting the latest update regarding All Government Schemes and Yojana

![PM Sahaj Bijli Har Ghar Yojana: Saubhagya 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/04/PM-Sahaj-Bijli-Har-Ghar-Yojana.webp)

![Nijashree Housing Scheme 2024 For LIG/MIG [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijashree-Housing-Scheme.webp)

![Hawker Support Scheme 2024: Eligibility and Benefits [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Hawker-Support-Scheme.webp)

![Nijo Griha Nijo Bhumi Scheme 2024 For Homeless People [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijo-Griha-Nijo-Bhumi.webp)

![West Bengal Gatidhara Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Gatidhara-Scheme-West-Bengal.webp)

![West Bengal Matsyajeebi Bandhu Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Bandhu-Scheme-in-West-Bengal.webp)

![Matsyajeebi Credit Card Scheme In West Bengal [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Credit-Card-Scheme-in-West-Bengal.webp)