PMAY Urban 2023 | Pradhan Mantri Awas Yojana Urban | PMAY-HFA (Urban) | PMAY-Urban Beneficiary | PMAY (U) Eligibility & Online Application

To provide housing for the MIG and EWS/LIG classes, the Indian government launched the Pradhan Mantri Awas Yojana – Housing for All (Urban) in 2015. This initiative is often referred to as PMAY-Urban or PMAY-HFA. PMAY Urban norms stipulate that a residence for the Economically Weaker Section (EWS) may contain up to 30 square meters of carpet space.

However, States/UTs may alter this limit in cooperation with the Ministry and with its consent. In this article, we will tell you all the details regarding Pradhan Mantri Awas Yojana Urban including its Objectives, Features, Eligibility Criteria, and Application procedure. So, read till the end.

Join our telegram group to get the latest updates regarding All Government Schemes and Yojana

Pradhan Mantri Awas Yojana Urban 2023

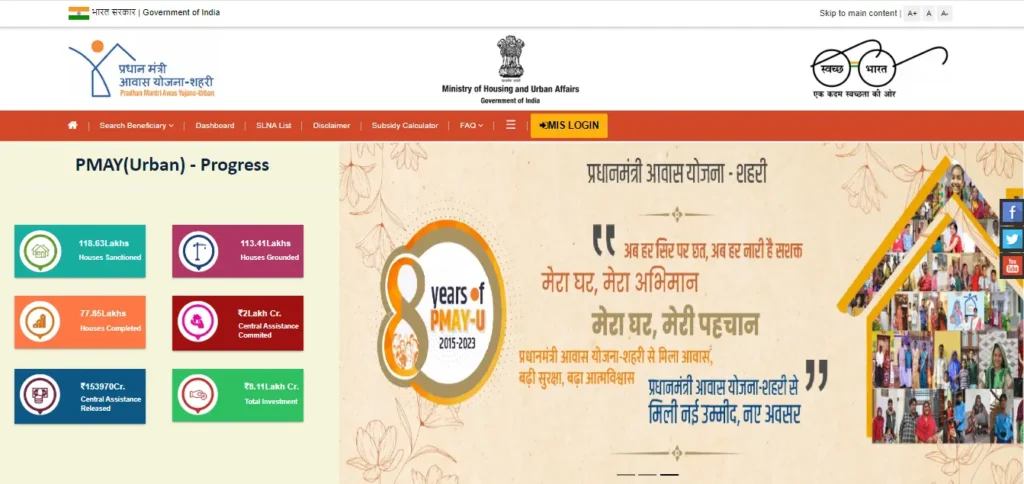

Operated in urban areas, the Pradhan Mantri Awas Yojana Urban (PMAYU) initiative aims to provide “Housing for All.” Both the federal government and local governments will provide support for the PMAY Urban program’s implementation in India’s State and Union Territories. A 6.5% interest subsidy will be provided by the government to the Low Income Group (LIG) and the Economically Weaker Section (EWS). 4% and 3%, respectively, for Middle-Income Groups I and II on house loans acquired by eligible recipients under the Credit Linked Serviced Scheme (CLSS) over a 20-year duration.

According to the PM Awas Yojana Urban Scheme, ground floor layouts must take into account the needs of the elderly and those with disabilities, as well as ecologically responsible development techniques. In an effort to provide “Housing for All” in urban areas, the Pradhan Mantri Awas Yojana Urban program has approved the construction of 1.05 crore dwellings, providing affordable accommodation for the city’s impoverished.

Overview of the PMAY-HFA (Urban) Scheme

| Name of the Scheme | Pradhan Mantri Awas Yojana Urban [PMAY (U)] |

| Initiated By | Government of India |

| Objective | Providing homes to the MIG and EWS/LIG groups |

| Benefits | Housing benefits to people living in urban areas |

| Official Website | https://pmaymis.gov.in/ |

Purpose of the PMAY (U) Scheme

- The Pradhan Mantri Awas Yojana – Urban program of the Indian government seeks to house every person living in urban areas.

- To close the disparity between the supply and demand of housing as it stands

- Encouraging affordable housing among the less fortunate members of society through the Credit Linked Subsidy Scheme (CLSS)

- To allow private developers to build pucca homes for the slum’s residents

- To give qualified households financial assistance for the construction of new dwellings

Features of the Pradhan Mantri Awas Yojana – Urban

- Depending on their income level, beneficiaries might receive a 6.5% interest rate subsidy on housing loans.

- Ground-floor accommodations will be given preference to senior persons and those with disabilities.

- One can get a loan to build a house or to purchase an existing one.

- A loan’s maximum term is 20 years.

- Sustainable and environmentally friendly technologies will be used for the buildings.

- Basic utilities including gas, electricity, and water hookups will also be offered.

PMAY Urban Eligibility Criteria

- You must not own a home in any region of the country.

- You have never received housing aid through any other program.

- If you apply as a married couple or joint owner, the grant will be awarded as one.

Eligibility for EWS, LIG, MIG I, & MIG II under PMAY Urban

| Economically Weaker Section (EWS) | Low Income Group (LIG) | Mid-Income Group (MIG) I | Mid-Income Group (MIG) II |

|---|---|---|---|

| Economically Weaker Section (EWS) people have a household income of Rs. 3 lakh or less. To apply for EWS benefits, however, you must provide the proper documentation. The maximum amount of carpet that can be utilized is 30 square meters. | This category covers persons with a monthly family income of between Rs 3 lakh and Rs 6 lakh. To be eligible for the benefits, you must provide an income certificate or other proof of income. The maximum carpet area permissible in this category under the PMAY Urban Scheme is 60 square meters. | People in this category earn less than Rs 12 lakh per year. You can apply for a loan of up to Rs. 9 lakh to build or purchase a 160-square-meter home. | If your annual household income falls between Rs 12 lakh and Rs 18 lakh, you are eligible to apply for a home under the PMAY Urban Scheme. A maximum square footage of 200 square meters qualifies for a housing loan of up to Rs 12 lakh. |

How to Apply for the PMAY Urban Scheme Online?

To apply for the PMAYHFA Urban Scheme online, follow the below-given steps.

- Visit the official site and click on the “Log in” option on the homepage.

- Select “Slum Dwellers” or “Benefits Under 3 Components” under “Citizen Assessment.”

- Then, insert your Aadhaar Number and Name.

- The system will next validate your Aadhaar information.

- Fill out the form with all of the necessary information.

- Then input the captcha code.

- Finally, click the “Submit” button to finish the application procedure.

Check the PMAY Application Status

The applicant should follow the below-given steps to check your PMAY (U) application status.

- Go to the PMAY Urban official website and click on “Track your Assessment Status” under “Citizen Assessment.”

- A new page will appear on the screen with two options for determining the state.

- Using the Assessment/Application ID

- Enter your Name, Father’s Name, and registered Mobile Number.

- Choose one of the options and provide the necessary information.

- Finally, click the “Search” button to see the application status on the screen.

PMAY Urban 2023 Guidelines

- The beneficiary family comprises the husband and wife, as well as any unmarried sons or daughters.

- Beneficiaries are unable to get assistance from any other government housing program.

- In any part of India, no family member shall own a pucca house in their name.

- If an adult household member does not own a pucca house in India, they are classified as a distinct household (regardless of marital status).

- Married couples are allowed to own a single home jointly or solely.

- When applying for a loan, family members’ Aadhaar numbers must be provided.

Important Links

| Join Telegram Group | CLICK HERE |

| Official Website | CLICK HERE |

Related Articles:

- Pradhan Mantri Awas Yojana List 2023 (PMAY 2023-24) – Check Now

- Pradhan Mantri Ujjwala Yojana 2023: Ujjwala 2.0 (PMUY)

- Indira Gandhi Awas Yojana 2023: Check IAY 2023 List

- Pradhan Mantri Awas Yojana – Urban (PMAY-U) Updated Guidelines

- Prime Minister Scholarship Scheme (PMSS) 2023 – Apply Now

Join our telegram group to get the latest updates regarding All Government Schemes and Yojana

![PM Sahaj Bijli Har Ghar Yojana: Saubhagya 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/04/PM-Sahaj-Bijli-Har-Ghar-Yojana.webp)

![Nijashree Housing Scheme 2024 For LIG/MIG [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijashree-Housing-Scheme.webp)

![Hawker Support Scheme 2024: Eligibility and Benefits [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Hawker-Support-Scheme.webp)

![Nijo Griha Nijo Bhumi Scheme 2024 For Homeless People [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Nijo-Griha-Nijo-Bhumi.webp)

![West Bengal Gatidhara Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Gatidhara-Scheme-West-Bengal.webp)

![West Bengal Matsyajeebi Bandhu Scheme 2024 [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Bandhu-Scheme-in-West-Bengal.webp)

![Matsyajeebi Credit Card Scheme In West Bengal [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/02/Matsyajeebi-Credit-Card-Scheme-in-West-Bengal.webp)

![West Bengal Sabla Scheme To Empower Adolescent Girls [Apply Now]](https://saralyojana.com/wp-content/uploads/2024/01/West-Bengal-Sabla-Scheme.webp)